What We Do

We provide a holistic service to ensure all areas of your financial life is taken care of, freeing up more time to do what you love. We specialise in Financial Advice, Lending Solutions and Wealth + Risk Protection.

We provide a holistic service to ensure all areas of your financial life is taken care of, freeing up more time to do what you love. We specialise in Financial Advice, Lending Solutions and Wealth + Risk Protection.

Our Annual review service is a holistic ongoing monitoring and review process to track and measure your progress towards achieving your financial goals. This service is suited to younger professionals, families, business owners and self-funded retirees.

Goal and objective setting is the first step in the financial planning process, and is a powerful tool that keeps you focused and on track. Think of it in the same way as a travel itinerary - detailing not only the destination itself, but a guide of exactly how to get you there.

We want to know what is important to you - your personal needs and the type of lifestyle you live to develop a personalised plan that addresses what you really want out of life. We look at the short and long-term before getting to work on paving the way towards achieving them. Establishing goals and objectives is at the heart of a financial plan, and without them we are unable to share your vision of where you ultimately would like to be.

Superannuation is a very valuable savings tool, and extremely tax effective. The earlier you start thinking strategically about how to make it work best for you, the better off you’ll be in the long run. By looking at the investment of the funds within your super plan and the ongoing contributions you make, we’re able to increase your benefit come time for retirement. To get the most out of your super we can address the following:

By understanding your goals and future aspirations we’re able to suggest a wide range of investment options and connect you with the right assets and products to help you achieve the financial security you’re after. When setting your financial goals, deciding on the structure of your investments is also crucial to managing risk.

Prior to setting up or reviewing your portfolio, we first determine the right course of action by assessing your risk profile and time frame to useability- this means recommending investments that will not only provide the returns you need to reach your financial goals, but also at the level of risk you can afford to take on now, and for the duration of your investment time horizon. We take care to ensure your assets are diversified across a sensible spread of asset classes to protect the total value of your investments and ensure they remain appropriate to your individual circumstance. We have the ability to tailor your diversified portfolio to meet any personal Ethical and Socially Responsible Investment preferences.

You could be retired for 30 years or more – that could amount to a third of your life! So it’s imperative to start planning now for what lies ahead. We work together to organise your assets and savings into a strategic plan to work towards meeting your goals for retirement, while maintaining the lifestyle you love. Some factors we will consider:

An essential part of ensuring your financial success is protecting your cash flow and assets in the event of an unforeseen event such as disability, incapacity and dare we say it - death. Wealth Protection is often overlooked in a financial strategy, which can have detrimental consequences on the wealth and future you've worked hard to build. If you happen to fall ill or have an accident that results in injury or sudden death, this area of advice can mean security and peace of mind for you and your family.

Disability, trauma or prolonged illness can affect your capacity to earn an income, and in most cases, leads to drawing on savings or home equity to cover medical and daily living expenses. This could affect your family’s current living standards and ultimately your retirement affordability / lifestyle. By addressing the amount required to pay off your debts, meet potential medical and carer costs, cover your children’s schooling as well as your ongoing income needs, we can ensure you and your family are sufficiently protected.

We conduct a comprehensive review process to track and measure your progress towards achieving your financial goals. We review your investments to ensure they remain appropriate and in line with your current position. Our Annual Review process covers:

The Wealth Connection - All services provided under the Financial Advice and Wealth & Risk Protection arm of the business is done so as an Authorised Representative of The Wealth Connection Pty Ltd ABN 46 169 584 472 Australian Financial Services Licensee 523 317

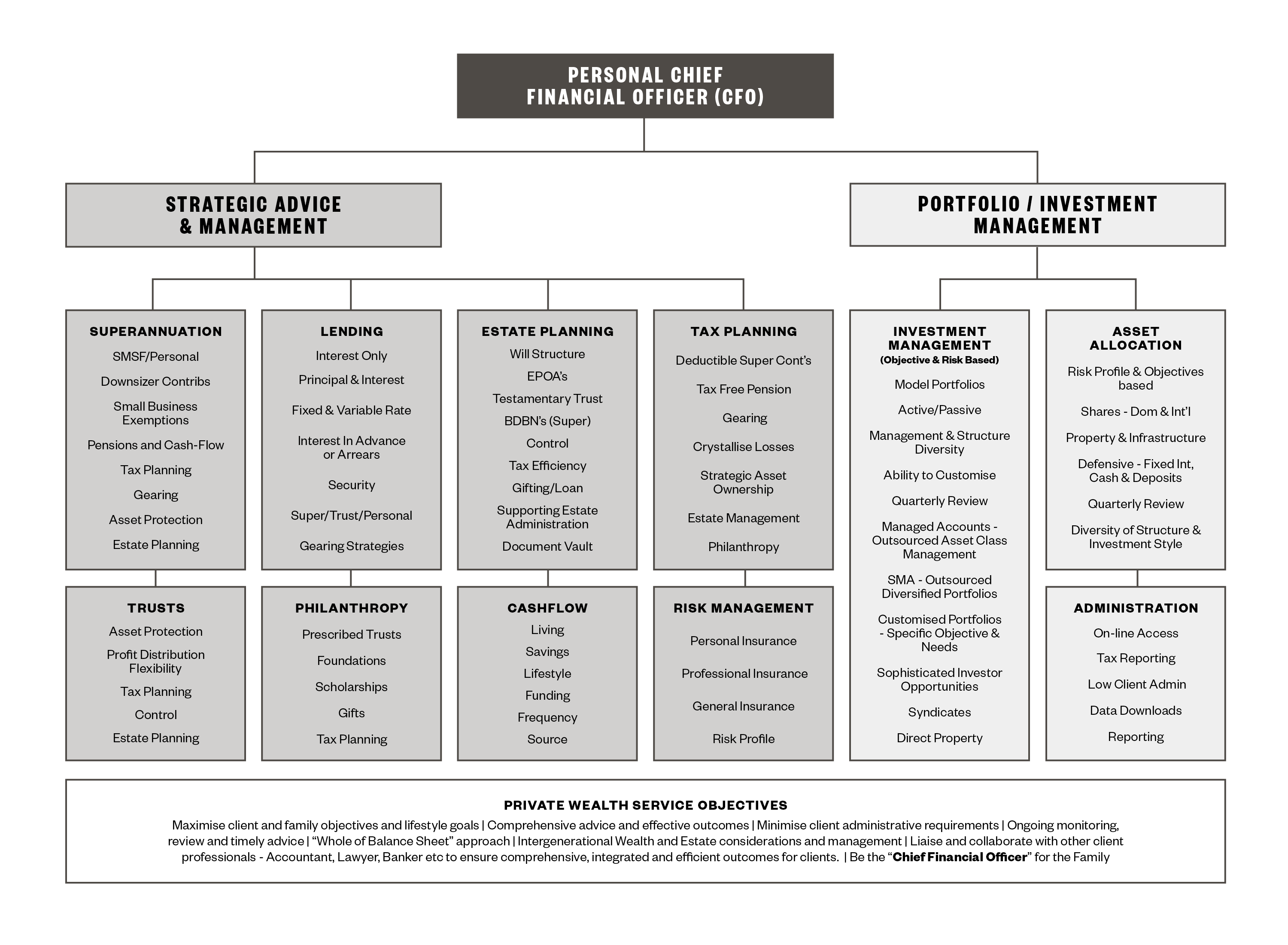

A comprehensive financial advisory and wealth management service suited to those who wish to have a long-term trusted adviser relationship. Your own private CFO to maximise and manage your financial and lifestyle goals and objectives.

Our Private Wealth Service is a comprehensive and integrated service approach offered to successful individuals and families, working with you in delivering high quality pro-active financial advice and wealth management services. Our purpose is to help you achieve your life goals and objectives.

We are your Private CFO (Chief Financial Officer), who will work with you to develop a comprehensive financial and lifestyle plan, ensuring all elements of your situation are considered and work in harmony to achieve your objectives. We will be advising, project managing and guiding you and your various trusted professionals towards your agreed plan. Most situations require ongoing management to attain goals and maximise outcomes. This process is often difficult for clients to manage due to vast levels of information available, specific and specialist knowledge required, and time commitment needed. We take a “whole of Balance Sheet” approach and provide you the ability to outsource this responsibility to us as your trusted family Adviser, who is totally aligned to your best interests. We act as your vanguard in protecting you from vested interests and inferior financial situations. We operate totally on a fee for service retainer basis, without external incentives or bias.

The service provides for regular ongoing Reviews and Updates (2 per annum) and meetings or discussions as required. This ensures you are fully informed no matter what the situation and have a key professional reference point to discuss any future requirements, changes or initiatives, as they arise. Clients are provided with on-line access to critical information, regardless of their location.

The Private Wealth Service allows you to focus on what is important to you, across your personal, business and family interests.

A professional advisory relationship and service that maintains a deep and comprehensive knowledge of the client’s affairs and objectives, that also effectively project manages the services and requirements of other professionals, to ensure a co-ordinated and effective outcome, on an ongoing basis.

The Private Wealth Service specifically encompasses the following:

Each PWS client (family) group has a dedicated team to ensure a highly personalised and dedicated service is provided and available. By having a small dedicated group of support people for each relationship, there is always a familiar face or voice available, who have a deep understanding of your situation as required. This also ensures consistent monitoring and management of your affairs and needs.

Your PWS Team:

The PWS fee is based on a fee for service / annual retainer model and calculated on time required and complexity for advisory services, and a scaled percentage for investment management. This ensures it is tailored to each client’s specific needs and circumstances.

Fees are totally independent of specific investments recommended or managed and the services used. We DO NOT receive commissions or incentives, allowing us to be totally aligned with our client’s best interests, without bias.

An invitation is extended to become a Private Wealth Service client, once an initial meeting and review of your complete situation and objectives has occurred, and suitability has been established.

A formal Financial Plan is then developed and provided, and once advice is accepted, all elements of the plan will be progressively implemented and monitored on an ongoing basis. Any changes will be dealt with efficiently and in the knowledge of the agreed future objectives, established and reviewed as required.

We will meet formally twice a year (Annual Review and Half-Year Update) or more regularly as required, in order to ensure all necessary actions are taken and decisions are made, to achieve your objectives. You will have ongoing access to the team as required throughout the year for any ad-hoc requests or for specific change in circumstance.

We will pro-actively contact you as circumstances require, ensuring all personal, legislative and structural issues are considered and assessed, as changes occur.

The Wealth Connection - All services provided under the Financial Advice and Wealth & Risk Protection arm of the business is done so as an Authorised Representative of The Wealth Connection Pty Ltd ABN 46 169 584 472 Australian Financial Services Licensee 523 317

TWC – Annual Review Service

Goals & Objective Setting

Superannuation

Investment & Asset Product Selection

Retirement Planning

Protecting You and Your Family

Annual Review Service

TWC – Private Wealth Service

Overview

Service Offering

Your Team and support

Pricing

Acceptance into the service & Implementation

Review & Monitoring

TWC Fin – Mortgage Broking

Home Lending

Investment Lending

Construction Finance

Refinancing

Medico Finance

Commercial Funding

The Wealth Connection Pty Ltd

Financial Advice

ABN 46 169 584 472

The Wealth Connection - Finance Pty Ltd

Mortgage Broking

ABN 21 602 960 636

Proud members of:

E. This email address is being protected from spambots. You need JavaScript enabled to view it.

Austinmer

P. (02) 4268 5555

A. 2/34 Moore Street, Austinmer NSW 2515

Canberra

P. (02) 6156 8002

A. 3/37 Canberra Avenue, Forrest ACT 2603

Milton

P. (02) 4454 2963

A. 3/41 Wason Street, Milton NSW 2539

The Wealth Connection Pty Ltd holds its own Australian Financial Services License (ABN 46 169 584 472 and AFSL 523 317). Your Adviser may offer you services through The Wealth Connection Pty Ltd and The Wealth Connection – Finance Pty Ltd which are each separate businesses. Although the same Adviser may offer you services under the above businesses, each business is solely and separately responsible for the advice they each provide. In particular, The Wealth Connection Pty Ltd is only responsible for the financial planning services provided by its Authorised Representatives.

This information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, you should consider whether the information is appropriate in light of your particular objectives, financial situation and needs.

The Wealth Connection Privacy Policy | The Wealth Connection Finance Privacy Policy Financial Services Guide