LENDING SOLUTIONS

At The Wealth Connection - Finance we assess your lending-specific requirements and conduct extensive market research to find the best solutions available to meet your personal needs.

HOME LENDING

Purchasing a residential property can be a stressful experience but it doesn’t need to be. Whether you’re navigating unchartered waters as a prospective first homeowner or preparing to buy a new home, we are experienced in arranging the finance you need to make your goal a reality with the least amount of worry. We simplify the process of buying a home with clear explanations and assistance all the way through to settlement – ensuring an attractive outcome while freeing up more time to enjoy life.

By comparing hundreds of products on the market we can provide you with a choice of loans and interest rates that are best suited to your individual situation. We can give in-depth advice and guidance to help you make a fully informed decision, and negotiate the best possible rate and terms for you.

INVESTMENT LENDING

Aligning your investment lending to your investment strategy is just as important selecting the right property. Loan structure & features can play a prominent role in determing what loan is best for you – much more so than purely interest rate comparison. It is vital you get it correct depending on your current position, goals and strategy. There are a myriad options to consider whether it be repayment types, incorporating offset features, or hedging against fluctuation of rates. You may also have the option of leveraging your current equity position to help you build a property portfolio.

We are fully equipped to guide you through the structuring, features and loan options which align to your greater plans. We conduct an in-depth analysis of your situation and strategy to ensure what we are recommending options to maximise the benefits of investing in property and building your net asset position. We’ll work with or help you build a team of professionals such as our advisors, accountants, buyer’s agents and solititors to ensure you’re making the right calls.

CONSTRUCTION FINANCE

Building a new home or undertaking renovations can be a hugely exciting time. The prospect of a dream coming to life in front of your eyes can be rewarding as it can be a logistical feat. Amongst dealing with builders, you’ll want to ensure you’ve got the funds available to make it a reality. Different lenders will look at construction in different ways so we want to make sure you qualify prior to knocking down walls.

At The Wealth Connection, we’ll walk through the options available to you and what you’ll need to do to ensure we can secure an approval when the time comes. It may be that we can use equity held in another property or leverage off a fixed price building contract to fund your requirements. It’s one of the first and most important steps in the whole process so you want to ensure it’s taken care of.

REFINANCING

The mortgage market fluctuates daily and you may be surprised by the variety of options available that could be more suited to your budget and personal needs – potentially at a lower cost. Your existing loan could be better structured or your rate could be out of market. Banks are consistently offering promotional interest rates and fee waivers available to our client which you could be taking advantage of.

We regularly find generous savings for clients by reverting to a cheaper offering whilst upgrading loan features. It is not uncommon for savings to be in the thousands potentially taking years off your loan term. The team at The Wealth Connection will help you weigh up your choices to ensure you’re getting the deal that best compliments your circumstances. From our extensive panel of lenders, we’ll identify those offering the best features; flexibility and options suited to your long term financial goals.

MEDICO FINANCE

As a medical professional, you may be privileged to benefits not available to applicants from other industries. There are a myriad of unique policies, rate discounts and fee waivers from a select group of lenders which can be applied depending on your needs and circumstance. This might include borrowing 95% on a residential property without Lender’s Mortgage Insurance, drawing unsecured lending to purchase goodwill or funding 100%+ costs for a new practice.

We are highly proficient in this niche area of finance and can guide you through the lending opporunties for any medical professional. We understand that a many of you may be time poor and ensure we bring our intimate understanding of this speciality to meet your demands and busy schedule. Whatever your experience or specialty, The Wealth Connection will be there for your lending requirements.

COMMERCIAL FUNDING

The Wealth Connection can assist you with the purchase, equity release, or refinance of commercial property including professional spaces, retail shops, warehousing, and industrial developments. Through our experience in managing complex financial transactions, we’re well positioned to assist with the financing of corporate property transactions with minimal stress and the right terms for a quick turnaround.

With access to an extensive panel of lenders, we can connect you to commercial property solutions that best fits your situation, simplifying your next commercial transaction.

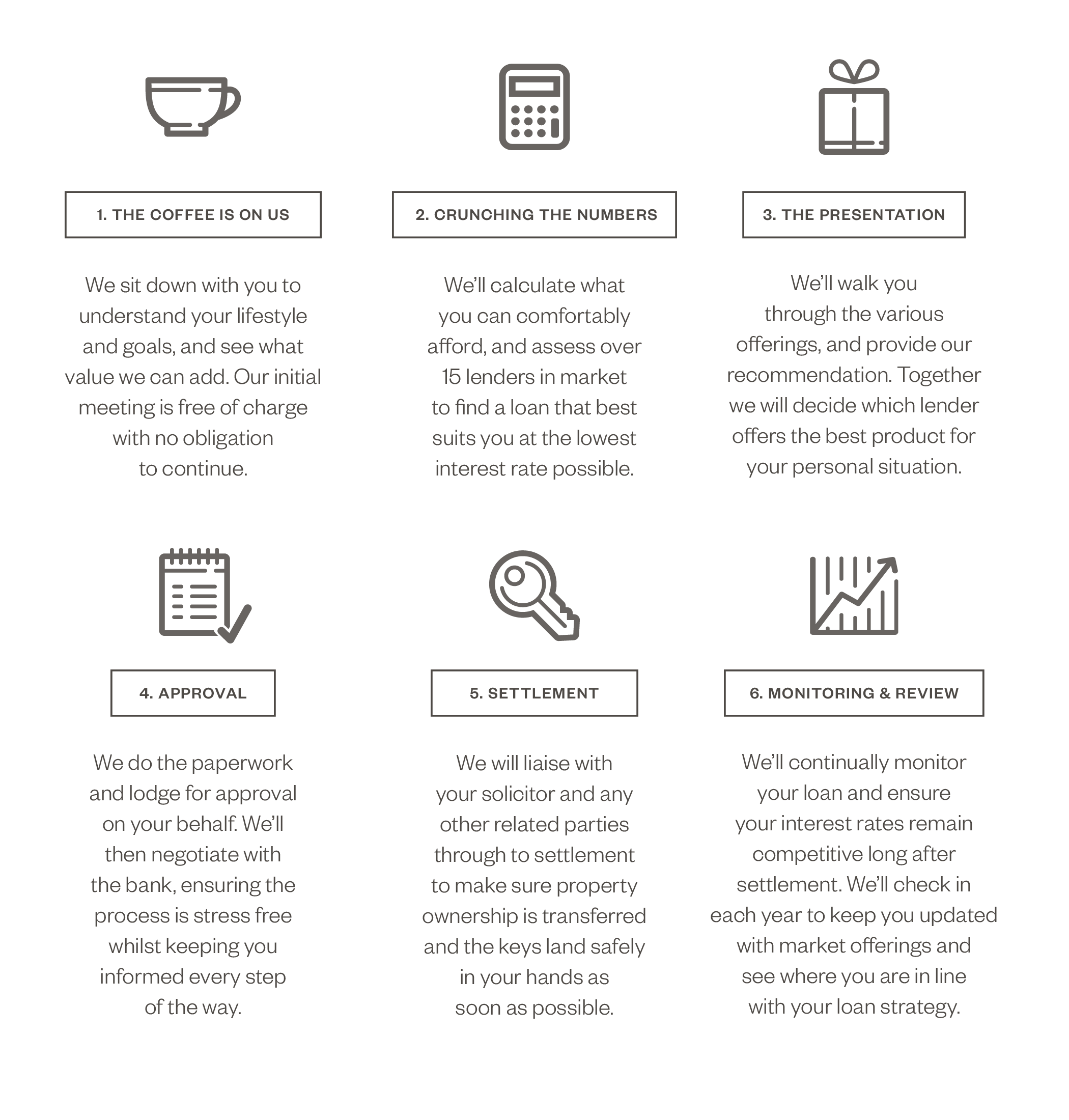

The Lending Process

Our Panel of Lenders

The Wealth Connection - Finance Pty Ltd - All services provided under the Lending arm of the business is done so as a Credit Representative of Connective Lender Services. Credit Representative Number 470969 and authorised under the Australian Credit License Number 389328